It is a top of the page.

- Home

- Sustainability

- Environment

- Climate Change Response

- TCFD Recommended Information Disclosure

TCFD Recommended Information Disclosure

Basic Policy

Duskin recognizes the risks and opportunities associated with climate change as a critical issue for our corporate management. In order to promote information disclosure based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), we have classified climate-related risks into two categories: risk associated with the transition to a low-carbon economy and risk associated with the physical impacts of climate change. We are examining these risks based on this classification.

Governance

Board of Directors' oversight of climate-related risks and opportunities and the role of management in assessing and managing climate-related risks and opportunities

In order to evaluate the impacts from climate-related risks and opportunities and integrate them into our business strategy, in 2017, we established the Sustainability Committee as an advisory body to the Board of Directors.

In addition to setting basic policy and the metrics and targets concerning climate-related risks and opportunities, the committee is responsible for reviewing, deliberating on, evaluating and improving major policies, thus providing a framework that enables the Board of Directors to understand and monitor the actual status of risks and opportunities and strengthen Duskin's climate-related governance.

In addition, by linking the Sustainability Committee with the Quality Assurance & Environment Committee, which plays a central role in Duskin's environmental management, it is possible to monitor — through the Environmental Liaison Committee — metrics-based performance at bases around the country and manage the progress toward achieving targets and plans.

Strategy

Identifying short-, medium-, and long-term climate-related risks and opportunities

Given climate-related change in the external environment, we have identified climate-related opportunities and risks that could potentially have a significant financial or strategic impact on Duskin.

| Category | External environment changes | Business risks & opportunities | Financial impact | ||

|---|---|---|---|---|---|

| Transition risks |

Policy, law, and regulations |

|

|

|

|

| Technology |

|

|

|

||

| Market and reputation |

|

|

|

||

| Physical risks |

Acute |

|

|

|

|

| Chronic |

|

|

|||

|

|

|

|||

| Opportunities | Resource-efficiency |

|

|

|

|

| Energy sources |

|

|

|||

| Market |

|

|

|

||

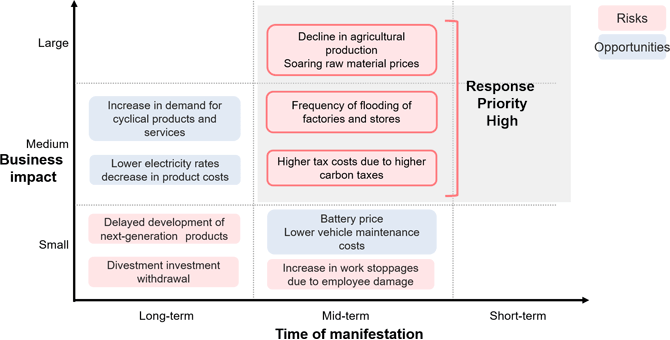

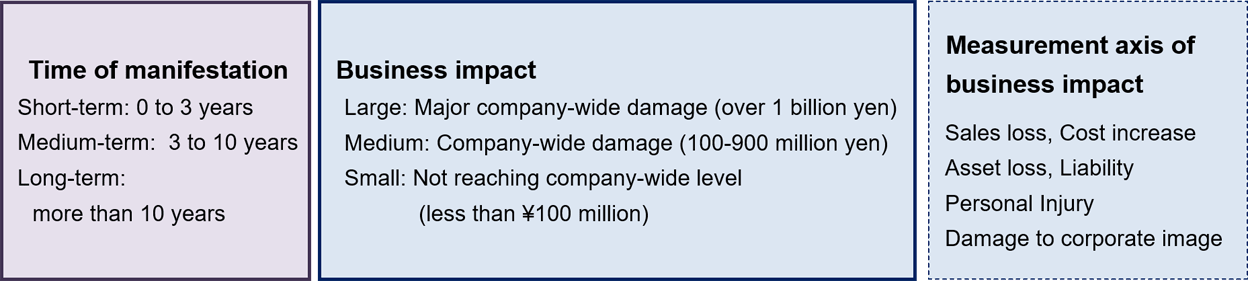

By screening the priority level of these risks and opportunities along two axes: "time until occurrence" and "business impact," we have identified three risks that currently should be considered highest in priority.

Risk and opportunity mapping based on relative evaluation

Production quantity decrease and raw material price hike for agricultural produce (wheat, coffee, palm oil)

The Food Group is a major business division of Duskin, and in order to provide a stable supply of products to customers, it selects important partner companies based on factors including their past performance track record. When the raw material production sites for these partner companies are concentrated in an area, there is a chance of being heavily impacted by raw material price hikes if production quantity decreases for agricultural produce as an effect of increases in the average temperature due to climate change.

Increases in plant/shop flooding frequency

Production & Logistics handles the production of mop and mat products as well as the recycling and resupplying of products that have been collected after being used by washing and reprocessing them. It has plants all over Japan. If a production plant stops operating due to the intensification of natural disasters brought on by climate change, this would most probably have an impact on the entire business.

Increased taxation costs due to higher carbon taxes

The core energy required for the products and services we sell is not electricity. Thus, significant electricity usage reduction through efforts including electricity streamlining is difficult, and we forecast the scope of electricity usage reduction through energy conservation efforts to be low. Therefore, if a carbon tax or other new regulations are introduced in the future, the financial impact could be a permanent burden.

The impact of climate-related risks and opportunities on business, strategies and financial planning

The three high priority risks that we have identified are a decline in the agricultural production of wheat, coffee and palm oil accompanied by soaring raw material prices, increased frequency of flooding at factories and shops, and higher tax costs due to a rise in carbon taxes. For these three high priority risks, we performed climate-related scenario analyses and calculated in detail the expected cost of their impact. We then prepared policies for responding to these risks that need to be incorporated into Duskin's business strategy.

Production quantity decrease and raw material price hike for agricultural produce (wheat, coffee, palm oil)

[Scenario]

- ●Impact from climate change (radiation emission is RCP8.5, temperature rises by 4°C)

- ●No impact from climate change (assuming permanent continuation of the 2005 climate)

Using the above scenarios, we established a forecast of change in the procurement price for agricultural produce, which is the core raw material for the Food Group, and evaluated the financial impact.

Increases in plant/shop flooding frequency

[Scenario]

- ●IPCC-RCP2.6: Average temperatures rise by approximately 2°C above pre-industrial levels

- ●IPCC-RCP8.5: Average temperatures rise by approximately 4.3°C above pre-industrial levels

Based on the Ministry of the Environment's TCFD Guidance, we calculated the amount of physical price damage (building and facility damage) to real estate from river flooding for directly managed and partner company plant facilities and the headquarters building in the case of a one-in-one-hundred-year flood event and evaluated the financial impact.

Increased taxation costs due to higher carbon taxes

[Scenario]

- ●IEA's 2050 net zero scenario (NZE2050): 1.5°C scenario

- ●IEA's stated policy scenario (STEPS): 3°C scenario

Using the above scenarios, we developed future greenhouse gas emissions forecasts based on current energy usage amounts and greenhouse gas emissions for domestic group branches and plants, and evaluated the financial impact accordingly.

Impact of high-priority risks on business and financial planning and policies for addressing them

| Business risk | Time until occurrence |

Business impact level |

Financial impact (Hundred million yen) |

Policies for addressing risks |

|---|---|---|---|---|

| Decline in agricultural production (wheat, coffee, palm oil) and soaring raw material price | Medium term | Large | 3.3 - 14 |

|

| Increased frequency of flooding at factories and shops | Medium term | Medium | 5.2 - 9.2 |

|

| Higher tax costs due to a rise in carbon taxes | Medium term | Medium | 1.3 - 4.3 |

|

Moving forward, based on response policies, we will narrow in on appropriate measures in management divisions and advance the strengthening of linkage with risk management work and operations.

Risk management

Our organizational process for identifying, evaluating, and managingclimate-related risks

When formulating strategies concerning climate-related risks and opportunities, the Sustainability Committee works together with the Corporate Planning Division to evaluate the importance level of each risk and opportunity. Risks and opportunities evaluated as potentially having an immense financial or strategic impact are reported to the Board of Directors, where the level of importance in corporate management is given a final resolution.

The progress of these strategy-based key measures is managed through a process of receiving reports pertaining to the amount of fuel and energy used in nationwide Duskin Group sites, including franchisees. The reports are received by the Sustainability Committee partner body Quality Assurance & Environment Committee through the Environmental Liaison Committee. Reports are made through an internal company system. When large increases or decreases are discovered by comparison to data collected over time, the cause is identified, and appropriate corrective response is employed.

Metrics and targets

Metrics used in evaluating climate-related risks and opportunities in line with strategy and risk management (Scope 1 and Scope 2 greenhouse gas emissions)

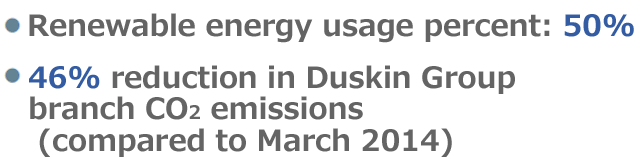

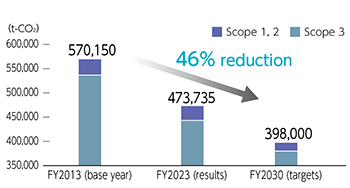

We set the metrics and targets used in evaluating the high-priority risk "Higher tax costs due to a rise in carbon taxes" as indicated below.

CO2 emissions

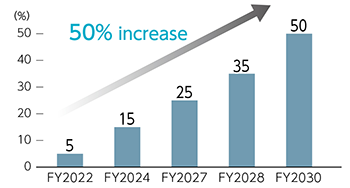

Targets for renewable energy use rate

| FY 2013 (base year) |

FY 2019 | FY 2020 | FY 2021 | FY 2022 | FY 2023 | Compared to the base year |

|

|---|---|---|---|---|---|---|---|

| Scope 1*(t-CO2) | 18,936 | 16,731 | 16,772 | 16,140 | 16,225 | 15,230 | -19.6% |

| Scope 2*Market-based*(t-CO2) | 20,381 | 19,555 | 19,430 | 16,803 | 15,368 | 15,516 | -23.9% |

| Scope 2*Location-based*(t-CO2) | 20,381 | 19,425 | 19,027 | 17,683 | 16,460 | 16,698 | -18.1% |

| Scope 3*(t-CO2) | 530,833 | 420,441 | 406,259 | 377,429 | 423,248 | 442,989 | -16.5% |

| Total Market-based*(t-CO2) | 570,150 | 456,730 | 442,461 | 410,372 | 454,841 | 473,735 | -16.9% |

| Total Location-based*(t-CO2) | 570,150 | 456,598 | 442,058 | 411,252 | 455,933 | 474,917 | -16.7% |

- Notes:

- *Scope 1: Greenhouse gas emissions directly emitted by the Duskin Group

- *Scope 2: Indirect emissions from the use of electricity, heat or steam supplied by other companies

- *Scope 3: Indirect emissions not included in Scope 1 and Scope 2 (Emissions by other companies engaged in activities related to the business)

- *Market-based: Calculated using emission factors for each type of electricity used

- *Location-based: Calculated based on the national average emission factor

In order to ensure information disclosure accuracy and transparency, we obtain third-party guarantees regarding CO2 emissions and renewable energy usage ratios.