It is a top of the page.

- Home

- Investor Relations

- Shareholder / Stock Information

- Shareholder Returns

Shareholder Returns

Dividend policy

Duskin recognizes the return of profits to shareholders as one of the management's top priorities. Its basic policy is to distribute a portion of the profit based on performance while preserving an appropriate balance with investments for sustainable growth and higher corporate value, and with maintaining financial soundness in preparation for potential risks. Accordingly, the Company determines the ordinary dividend for each fiscal year based on a consolidated payout ratio of 60% or a dividend on equity ratio (DOE) of 3.0%, whichever is higher.

Furthermore, the Company flexibly repurchases its own shares in a manner that reflects the market environment and cash flows with the aim of increasing shareholder value and ROE.

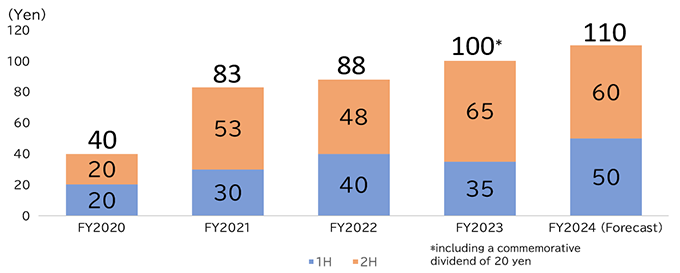

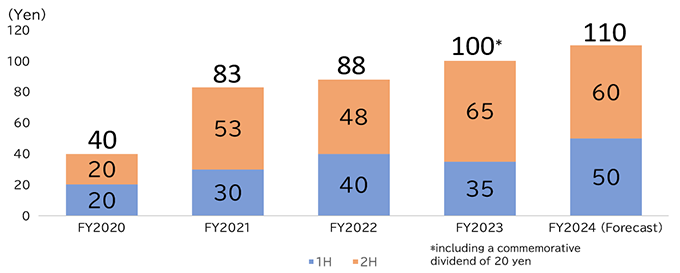

Dividend amount

The new dividend policy is effective from the FY2022 interim dividend.

Capital, shares issued and shares repurchased

| Capital (million yen) |

Total number of shares issued (thousand shares) |

Number of treasury shares at the end of fiscal year (thousand shares) |

Number of shares repurchased (thousand shares) |

Cost of share repurchase (million yen) |

|

|---|---|---|---|---|---|

| FY 2024 | 11,352 | 48,000 | 879 | 1,328 | 4,999 |

| FY 2023 | 11,352 | 50,000 | 1,572 | 527 | 1,696 |

| FY 2022 | 11,352 | 50,994 | 2,051 | 1,094 | 3,303 |

| FY 2021 | 11,352 | 50,994 | 975 | — | — |

| FY 2020 | 11,352 | 50,994 | 1,650 | — | — |

| FY 2019 | 11,352 | 50,994 | 1,659 | 2,679 | 7,777 |

| FY 2018 | 11,352 | 52,694 | 679 | 1,429 | 3,750 |

| FY 2017 | 11,352 | 55,194 | 1,750 | — | — |

| FY 2016 | 11,352 | 55,194 | 1,749 | 2,100 | 4,415 |

| FY 2015 | 11,352 | 57,494 | 1,948 | 5,000 | 10,503 |

| FY 2014 | 11,352 | 63,494 | 2,947 | 1,030 | — |

| FY 2013 | 11,352 | 63,494 | 1,915 | 1,500 | 2,835 |

Note: The numbers of shares are rounded down to the nearest thousand shares.

Shareholder benefits

As a sign of our gratitude towards all of our shareholders, we have established a Shareholder Benefits System.

It is our hope that you use Duskin products and services through the Benefits System and learn more about our business through firsthand experience.