It is a top of the page.

- Home

- Sustainability

- Governance

- Corporate Governance

Corporate Governance

Basic Policy

Upholding Founder Seiichi Suzuki's philosophy of Prayerful Management, we have forged onward with each of our business operations for the purpose of sowing the seeds of joy for people and communities. Our interpretation of corporate governance is for all of our employees to fully incorporate his earnest wish, as reflected in his philosophy, in our everyday activities.

Duskin positions the strengthening of corporate governance as one of its highest management priorities to build a stronger relationship with various stakeholders, increase corporate value over the medium to long term, and achieve sustainable growth. Therein, Duskin is further bolstering its structure, organization and systems to ensure highly transparent and sound management. Duskin also places compliance at the center of all corporate activities to continuously improve its corporate value.

Management PhilosophyApproach to corporate governance

Duskin ensures the implementation of all of the principles contained in the Corporate Governance Code. For additional information, please refer to our Corporate Governance Report.

Initiatives to strengthen corporate governance

We are strengthening corporate governance, as we believe it to be one of the most important issues for business management. In 2017 we created a Directors Evaluation Committee and introduced an Operating Officer System in 2018. In 2019, we changed the Directors Evaluation Committee to consist of only independent Directors and to function as an advisory body to the Board of Directors. In 2022, we also increased the number of female Outside Directors by one to three. Taking into account amendments to laws and changing society, We will continue to work toward further improvements in corporate governance.

Five Key Characteristics of Corporate Governance

| 1 | Ratio of Outside Directors on the Board of Directors 33% |

|

|---|---|---|

| 2 | Ratio of women on the Board of Directors 33% |

|

| 3 | Board of Directors attendance rate 100% |

|

| 4 | Establishment of a Directors Evaluation Committee |

|

| 5 | Building a structure that allows Board members to comprehensively deliberate on important matters |

|

| 2003 | Quality Assurance Committee (now Sustainability Committee) established |

|---|---|

| Compliance Promotion Committee (now Compliance Committee) established | |

| 2006 | Management Philosophy included in the Articles of Incorporation |

| A basic policy for the Internal Control System established | |

| Risk Management Committee established | |

| Duskin stock listed on the first section of Tokyo Stock Exchange and Osaka Securities Exchange* * The cash equity markets of Tokyo Stock Exchange and Osaka Securities Exchange were integrated on July 16, 2013. |

|

| 2007 | The Directors' retirement benefit program terminated |

| 2008 | The number of Outside Audit and Supervisory Board Members increased from two to three |

| 2013 | Starts participating in Electronic Voting Platform |

| 2014 | The number of Outside Directors increased from one to two |

| 2015 | Outside Directors and Audit and Supervisory Board Members Council established |

| The number of Outside Directors increased from two to three | |

| Posting of shareholders' meeting notice on the web (earlier than distributing printed version) started | |

| 2016 | Analysis and evaluation of the effectiveness of the Board of Directors started |

| 2017 | A share-based remuneration-type stock option program established |

| Directors Evaluation and Nomination System introduced | |

| Directors Evaluation Committee established | |

| 2018 | Operating Officer System introduced |

| The number of Directors decreased from not more than 15 to not more than 12 | |

| Independent Outside Directors account for at least one third of all Directors | |

| 2019 | Advisory body function of the Directors Evaluation Committee switched to the Board of Directors instead of to the President |

| 2020 | Succession Plan to train and develop next-generation management launched |

| Operations restructured into groups; COO and CFO designated | |

| 2021 | Share-based remuneration-type stock options replaced with a restricted stock remuneration plan |

| Hybrid virtual shareholders' meeting (a meeting in which online participants do not have voting rights) held | |

| 2022 | Three female independent Outside Directors appointed |

| Moved from the first section of the Tokyo Stock Exchange to its Prime Market | |

| 2023 | Disclosed information on our initiatives to realize business management that takes into account the capital cost and stock price. |

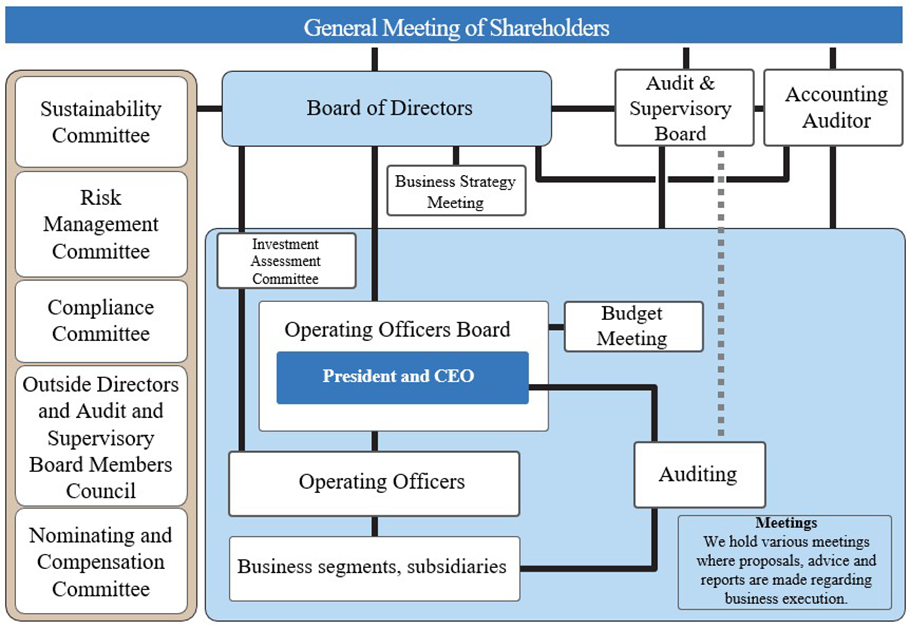

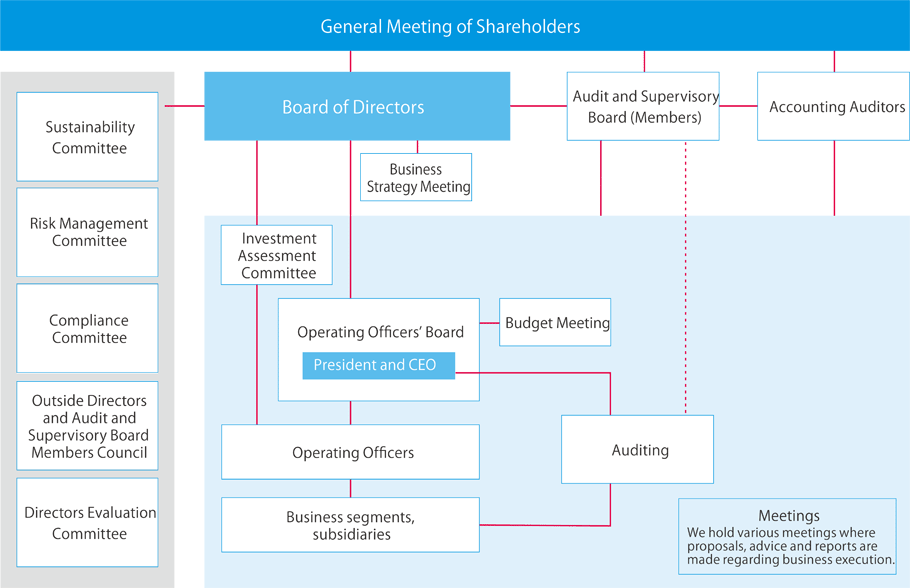

Corporate governance structure

Duskin corporate governance uses an audit and supervisory board system. Furthermore, Duskin has introduced an Operating Officers System with the goal of strengthening the decision-making and supervisory function of the Board of Directors and as a means to accelerate the performance of operations. To ensure the system's effectiveness, we maintain a Directors Evaluation and Nomination System. And to ensure objectivity and transparency pertaining to decisions on remuneration for each Director, we maintain a Nominating and Compensation Committee as an advisory body to the Board of Directors. At the Board of Directors, Directors, who typically serve concurrently as Operating Officers, monitor and supervise the performance of other Directors. The Audit and Supervisory Board consists of independent outside Audit and Supervisory Board Members capable of objectively conducting audits and internal full-time Audit and Supervisory Board Members, who are well acquainted with our business operations and have skills needed to gather information. Under this system, the Audit and Supervisory Board members, internal and outside, perform accurate audits. We consider this structure highly effective as it supports customer-oriented management while ensuring sound and efficient business operations. This system also enables us to swiftly and precisely respond to changes in the business environment.

Corporate governance structure (as of March 31, 2025)

Board of Directors

Chair: Hiroyuki Okubo, Representative Director, President and CEO

- Main function

- Make decisions concerning important Duskin Group business matters and supervise business execution.

In order to maintain business health, efficiency, and effectiveness and to ensure the balance required to make successful high-level business judgments across a wide array of business domains, Duskin appoints up to 12 Directors, considering diversity in areas including capabilities, experience, career histories, and gender. With this foundation, the Board of Directors is able to fulfill its function of making important decisions and supervising business execution, and is equipped with a system that can respond quickly and accurately to changes in the business environment.

| Name | Title | Tenure | Nationality | Age | Corporate Management | Sustainability | Corporate Governance | Finance and Accounting | Sales and Marketing | IT and Digital Transformation | Global Expansion | Franchise Operation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Okubo |

Representative Director, President and CEO | 5 | Japan | 62 | ○ | ○ | ○ | ○ | ○ | ○ | ||

Wada |

Director and COO | 5 | Japan | 62 | ○ | ○ | ○ | ○ | ○ | |||

Ueno |

Director and Operating Officer | 3 | Japan | 61 | ○ | ○ | ○ | ○ | ○ | |||

Emura |

Director and COO | 1 | Japan | 53 | ○ | ○ | ○ | ○ | ○ | |||

Iida |

Director and CFO | - | Japan | 60 | ○ | ○ | ○ | |||||

Nemoto |

Director and Operating Officer | - | Japan | 57 | ○ | ○ | ○ | |||||

Musashi |

Outside Director | 3 | Japan | 65 | ○ | ○ | ○ | ○ | ||||

Nakagawa |

Outside Director | 1 | Japan | 56 | ○ | ○ | ○ | |||||

Sekiguchi |

Outside Director | 5 | Japan | 56 | ○ | ○ | ○ | ○ | ○ | |||

Naito |

Audit and Supervisory Board Member | 5 | Japan | 63 | ○ | ○ | ○ | ○ | ||||

Tsukamoto |

Audit and Supervisory Board Member | 1 | Japan | 61 | ○ | ○ | ||||||

Saruki |

Outside Audit and Supervisory Board Member | 3 | Japan | 49 | ○ | ○ | ||||||

Sakamoto |

Outside Audit and Supervisory Board Member | 1 | Japan | 64 | ○ | ○ | ○ | |||||

Yamamoto |

Outside Audit and Supervisory Board Member | 1 | Japan | 50 | ○ | ○ | ○ |

- Note:

-

- 1. The number of service years and age are as of the end of the 63rd Annual General Meeting of Shareholders.

- 2. This is not a comprehensive summary of the entire set of knowledge, experience, and capabilities of the candidates.

| Skills | Requirements (skill summary) |

|---|---|

| Corporate Management | Ability to allocate business resources effectively based on human resource skills and sow the seeds of joy for people and society, in order to achieve sustained growth and raise corporate value over the medium to long term while striving to co-exist and co-prosper with the environment and local communities |

| Sustainability | Ability to help raise corporate value and achieve a sustainable society while sowing the seeds of joy for people and society and striving to co-exist and co-prosper with the environment and local communities, based on our franchise business system |

| Corporate Governance | Ability to build and enhance a corporate governance structure that is trusted by all stakeholders, based on skills such as risk management skills and legal and compliance skills to accurately identify risks and their impact in a fast-changing business environment and to implement proactive measures to prevent crises and minimize losses during emergencies |

| Finance and Accounting | Accounting and strategic financial skills that come with well-founded knowledge and experience required for strategic financial planning to forge a solid financial foundation, invest in growth and enhance shareholder returns |

| Sales and Marketing | Strategic marketing skills, including those for developing and manufacturing (production) of products and services, required for our franchising businesses |

| IT and Digital Transformation | Ability to drive corporate reform across Duskin's products, services and business models, as well as the corporate culture and climate, by using data and digital technologies: this is a skill required nowadays with digitalization on the rise as lifestyles change |

| Global Expansion | Ability required for capturing new growth opportunities not only in the domestic market affected by aging and a declining birthrate, but also with an eye toward entering emerging overseas markets following their growing populations |

| Franchise Operation | Ability to lead operations as a franchisor, including organizational development: this is a skill especially required by Duskin — a pioneer for franchising in Japan and currently a franchisor for almost all of its businesses |

Business Strategy Meeting

Chair: Hiroyuki Okubo, Representative Director, President and CEO

- Main function

- Discuss company-wide business strategies, business portfolios and the allocation of Duskin Group resources, etc. from a medium- to long-term perspective.

The Business Strategy Meeting is for all Directors and division managers to discuss company-wide business strategies, business portfolios and the allocation of Duskin Group resources, etc. from a medium- to long-term perspective.

Advisory bodies

Sustainability Committee

Chair: Keiichi Emura, Board Director and Operating Officer

- Main function

- Determine the medium-term framework and annual action plans regarding sustainability and deliberate on how to address unresolved sustainability issues.

To achieve corporate growth and contribute to building a sustainable society, we maintain the Sustainability Committee, which is an advisory body to the Board of Directors. The purpose of the committee is to determine priority issues and the scope of action for ESG and SDGs to implement sustainable management across the Duskin Group.

Risk Management Committee

Chair: Kenji Iida, Operating Officer

- Main function

- Discuss and report on matters concerning the annual risk management plan, the causes of and countermeasures against risks of development of diseases, and countermeasures against COVID-19.

Duskin has a Risk Management Committee serving as an advisory body to the Board of Directors. Its purpose is to take countermeasures against all risk factors at the Duskin Corporate Group as well as to avoid or minimize damages in the event that risks occur.

Compliance Committee

Chair: Kenji Iida, Operating Officer

- Main function

- Discuss and report on matters such as the compliance system, annual plans, training plans and the operational status of the whistleblowing system.

Duskin has a Compliance Committee serving as an advisory body to the Board of Directors. Its purpose is to implement and instill as well as to ensure adherence to the compliance system for the Duskin Corporate Group.

Outside Directors and Audit and Supervisory Board Members Council

Chair: Yukiko Tsujimoto, Outside Director

- Main function

- Make recommendations for increasing corporate value over the medium to long term.

Duskin maintains an Outside Directors and Audit and Supervisory Board Members Council, which is an advisory body to the Board of Directors. Its purpose is to provide beneficial views for ensuring effective corporate governance, while enabling Outside Directors and Outside Audit and Supervisory Board Members to gather information appropriately without affecting their independence. This makes it possible to monitor and supervise Duskin's management from a transparent, fair and objective viewpoint

Directors Evaluation Committee

Chair: Yukiko Tsujimoto, Outside Director

- Main function

- Provide necessary advice in response to consultations from the Board of Directors in selecting candidates for Directors and Operating Officers and in determining their remuneration.

This committee provides necessary advice in response to consultations from the Board of Directors in selecting candidates for Director and Operating Officer positions and in determining their compensation. It consists of only independent Directors — two Outside Directors and one Outside Audit and Supervisory Board Member — which allows the committee to function more effectively and with enhanced objectivity and transparency.

Executive bodies

Operating Officers' Board

Chair: Hiroyuki Okubo, Representative Director, President and CEO

- Main function

- Deliberate important matters related to business execution.

For the President and CEO to conduct business operations based on the basic management policy established at the Board of Directors meetings, Duskin maintains an Operating Officers' Board, a deliberative body to examine important business matters.

Budget Meeting

Chair: Hiroyuki Okubo, Representative Director, President and CEO

- Main function

- Monitor budget progress for each business division, identify the discrepancies between forecasts and actual results and discuss measures to be taken.

The Budget Meeting is held to monitor budget progress for each business division, identify the discrepancies between forecasts and actual results and discuss measures to be taken, as well as to share information on such issues.

Investment Assessment Committee

Chair: Naoto Miyata, Board Director and CFO

- Main function

- Raise the quality of investments in new business developments as well as facilities. Furthermore, ensure post-investment monitoring.

The Investment Assessment Committee was established to raise the quality of investments in new business developments and facilities. It also performs post-investment monitoring. The committee meets to deliberate as needed.

| Board/Committee | Membership | Actual number of meetings held in one fiscal year |

|---|---|---|

| Board of Directors |

|

17 |

| Audit & Supervisory Board |

|

13 |

| Sustainability Committee |

|

2 |

| Risk Management Committee |

|

2 |

| Compliance Committee |

|

4 |

| Outside Directors and Audit & Supervisory Board Members Council |

|

13 |

| Directors Evaluation Committee |

|

6 |

| Business Strategy Meeting |

|

2 |

| Operating Officers' Board |

|

12 |

| Budget Meeting |

|

8 |

| Investment Assessment Committee |

|

4 |

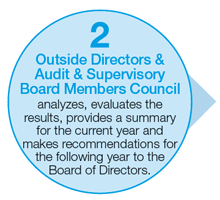

Evaluating Board of Directors effectiveness

Duskin analyzes and evaluates the effectiveness of the entire Board of Directors annually in order to achieve medium- and long-term sustainable growth and stronger corporate value.

The FY2023 analysis and evaluation process, the obtained results, and FY2024 plans are as follows.

Analysis and evaluation process

Target and period: 13 meetings of the Board of Directors held between April 2024 and December 2024

| Analysis and evaluation period | December 13, 2024 - January 10, 2025 |

|---|---|

| Regarding the effectiveness of the Board of Directors |

|

| FY 2024 Initiatives | Progress | |

|---|---|---|

| Continue discussions on business portfolio optimization and corporate value improvement. | While securing continuous revenue streams, keep examining each business from the perspective of capital cost, and through discussions on focusing on core competencies, make further progress in discussions about future business portfolio structure. |

|

| Promote cross-organizational digital strategies aimed at lifting productivity and efficiency. | ||

| To further clarify the responsibilities of business management, review the evaluation system for officers. At the same time, identify a diverse range of management personnel candidates by training employees. | Continue treating the evaluation system for management personnel (including Operating Officers) as a priority issue and proceed further with discussions. |

|

| Motivate employees to self-develop. Identify management personnel candidates among women and the younger generation. | ||

| Conduct fruitful discussions on coexistence with society and enhance corporate value. | Accelerate discussions on the medium- to long-term vision for sustainability management. |

|

| Provide more detailed explanations on sustainability initiatives and corresponding efforts. | ||

- Note: The DiSC theory classifies personality traits into four types: Dominance (D), Influence (I), Steadiness (S) and Conscientiousness (C). The theory can be applied to improving communication by understanding each type.

FY2025 initiatives

The Company's Board of Directors will continue to broaden discussions aimed at further enhancing the Board's overall effectiveness. For the fiscal year ending March 31, 2026 (FY2025), the Company will focus on the following initiatives:

- 1. With a mind to flexibly and swiftly address business environmental changes in and outside Japan, further conduct focused discussions on enhancing corporate value.

- a. Advance further with capital-conscious, data-driven management. Identify Duskin's competitive advantages, and continue and deepen discussions on optimizing the business portfolio.

- 2. Ensure actual implementation of the new Medium-Term Business Plan that begins in FY2025.

- a. Strengthen the monitoring of KPI progress.

- b. Fortify the monitoring of investment projects.

- c. Deepen the discussions of core strategies.

- 3. Conduct focused discussions on the corporate vision, the system for nominating and evaluating executives, the compensation system for executives, and the corporate succession plan.

Election policies for Board Directors

Selection standards

Duskin selects candidates for election as Directors from among individuals who fulfill the criteria of possessing the character, knowledge and integrity to serve as a Director and who have no health issues that would interfere with performing the duties of a Director.

◆Internal Director candidates

- The Representative Director requests recommendations from the current Directors and Audit and Supervisory Board Members.

- From amongst the recommendations, the Representative Director selects the candidate who will serve as a reliable driving force for the Duskin Group's medium- to long-term growth strategy, and who will have a positive effect on the organization's vitality.

- The Board of Directors makes final selections after thorough discussions, with advice from the Directors Evaluation Committee.

◆Outside Director candidates

- ◆Must not have any special financial relationship with Duskin Group

- ◆Must be able to maintain independence

- ◆Must have a business career and professional knowledge needed to actualize the supervisory and advisory functions of the Board of Directors

- ◆Must be able to provide useful advice from a multifaceted perspective in order to maintain the transparency and soundness of management and the fairness of procedures

After thorough discussions, the Board of Directors makes the final selection among candidates who meet the aforementioned criteria.

Under the provisions of Article 427, Paragraph 1 of the Companies Act, Duskin maintains contracts with Outside Directors that limit their damage compensation liability as provided in Article 423, Paragraph 1 of this act. The maximum damage compensation liability under the contracts is the amount as provided in laws and ordinances.

| Name | Reasons for appointment |

|---|---|

| Fumi Musashi | Ms. Musashi has been involved in business operations in China since joining Chori Co., Ltd., including breaking new ground for the company as its first female expatriate. Ms. Musashi also brings with her management experience accumulated since 2018 during her appointment as Chairman and President of Chori (China) Co., Ltd., a subsidiary in China. Ms. Musashi was appointed Outside Director because, based on her experience in global business operations and expertise, she is expected to provide comprehensive supervision of management and advice from the perspective of enhancing medium- and long-term corporate value. |

| Rie Nakagawa | During her career with Misumi Group Inc., Ms. Nakagawa held several key positions including president of the FA Business Company specializing in mechanical components used in factory automation (FA), and identifying ESG management issues and formulating policies to address them as Representative Corporate Officer in charge of sustainability promotion. Ms. Nakagawa was appointed Outside Director because she is expected to provide comprehensive supervision of management and advice from the perspective of enhancing medium- and long-term corporate value. |

| Nobuko sekiguchi | After working as a management consultant, Ms. Sekiguchi joined CAPCOM Co., Ltd., where she played a key role in corporate planning and personnel system reforms as a Managing Corporate Officer. Her corporate planning responsibilities included the formulation of a Mid-Term Plan, annual budget management, corporate reorganization and M&A transactions. From June 2019 to June 2024, she held the position of Outside Director at Duskin. During her tenure, she drew on her experience and expertise to lead the Company's discussions on IT and digital transformation (DX), thereby significantly contributing to enhancing the effectiveness of Board of Directors meetings. Ms. Sekiguchi is expected to provide comprehensive supervision of management and advice from the perspective of enhancing medium- and long-term corporate value. Therefore, the Company requests a vote in her favor for election as an Outside Director. |

- Note: All three are independent directors.

Standards for independence of Outside Directors and Outside Audit and Supervisory Board Members

To ensure the independence of Outside Directors and Outside Audit and Supervisory Board Members, Duskin selects members in accordance with our own selection criteria* as well as the independence standards of the Enforcement Rules for Securities Listing Regulations of the Tokyo Stock Exchange.

When selecting the candidates, Duskin confirms that they comply with all items of the criteria. Then, the Board of Directors makes the final decision after thorough discussions.

*Independence standards for outside directors established by our company are as follows.

Standards for Independence of Outside Directors and Audit and Supervisory Board Members

The independence of an Outside Director or Outside Audit and Supervisory Board Member requires that none of the following items is applicable to these individuals. These standards are based on the independence standards of the Securities Listing Regulations Enforcement Rules of the Tokyo Stock Exchange and include also standards established by Duskin.

- 1.

- A Director (except an Outside Director of Duskin), Audit and Supervisory Board Member (except an Outside Audit and Supervisory Board Member of Duskin) or employee of one of the Duskin Corporate Group *

- *Duskin Co., Ltd. and its consolidated subsidiaries

- 2.

- A Director, Audit and Supervisory Board Member or employee of a major shareholder* of Duskin or a company or other organization where Duskin is a major shareholder

- *An individual, company or other entity that owns at least 10% of Duskin's voting rights

- 3.

- A Director, Audit and Supervisory Board Member or employee of a company in a major business relationship* with the Duskin Corporate Group

- *A company where, in the most recent fiscal year, amounts paid to or received from the Duskin Corporate Group for business transactions exceed the larger of 2% of the consolidated sales of the Duskin Corporate Group or the company (including the parent company and subsidiaries) or 1 billion yen

- 4.

- An individual that has received substantial donations* from the Duskin Corporate Group or an Executive Director or other Board Director, Audit and Supervisory Board Member or employee of a company or other organization that has received such donations

- *Substantial donations are cash and other financial assets with a value exceeding the larger of 1% of the consolidated sales of the Duskin Corporate Group in the most recent fiscal year or 100 million yen.

- 5.

- An attorney, accountant, consultant who has received substantial payments* or other financial assets (or an individual belonging to a company or other organization that has received these payments) other than Director or Audit and Supervisory Board Member compensation from the Duskin Corporate Group

- *Substantial payments are cash and other financial assets with a value exceeding the larger of 1% of the consolidated sales of the Duskin Corporate Group in the most recent fiscal year or 100 million yen.

- 6.

- An individual who was ever in any position described in the above items 1 and 2

- 7.

- An individual who was within the past three (3) years in any position described in the above items 3 through 5

- 8.

- Spouses and first- or second-degree relatives of individuals described in the above items 1 through 7

- 9.

- An individual whose total cumulative tenure as a Duskin Outside Director exceeds ten (10) years, or as a Duskin Outside Audit and Supervisory Board Member exceeds eight (8) years

- 10.

- An individual who provides any other reasons for doubt about independence concerning the performance of duties as a Duskin Outside Director or Outside Audit and Supervisory Board Member

Officer remuneration

Duskin positions Directors' remuneration as an important issue for our corporate governance. To raise Directors' motivation to achieve medium- and long-term sustainable growth and enhance corporate value, Duskin established the Directors Evaluation and Nomination System. With this system in place, their contributions, capabilities, and qualities are evaluated and reflected in their remuneration. The methods used in calculating Director remuneration and actual remuneration in FY 2024 are as follows.

| Items | Methods applied in the fiscal year ended March 31, 2024 | ||

|---|---|---|---|

| Board Directors | Outside Directors | Audit and Supervisory Board Members | |

| Decision-making Process |

|

|

|

| Remuneration | The remuneration consists of basic remuneration (fixed amount), bonus (performance-based) and restricted stock remuneration* (medium- to long-term incentive).

|

|

|

- Note: Remuneration is determined within the amount resolved at the general shareholders' meeting.

Policy on determining the percents for figures including individual Director remuneration amounts

The remuneration percentage for each type of director is deliberated at the Directors Evaluation Committee based on the benchmarks of remuneration standards and percentages from companies of the same business size, industry, and category as Duskin. With full weight given to the report from the Directors Evaluation Committee, the Board of Directors determines the remuneration, etc., of each individual Director within the remuneration percentages given for each category within that report.

| Director position | Composition of remuneration | Total | |||

|---|---|---|---|---|---|

| Basic remuneration (Fixed amount) |

Bonus (Performance-based) |

Restricted stocks | |||

| Representative Director |

President and CEO | 66.4% | 19.0% | 14.6% | 100.0% |

| Board Directors | Business/Administrative Group Operating Officers | 69.7% | 18.0% | 12.3% | |

| Operating Officers | 74.6% | 15.2% | 10.2% | ||

- Note:

-

- 1. The basic remuneration amount is composed of fixed remuneration and position-based remuneration, and the composition ratio is calculated based on the median value of the five-level position-based remuneration.

- 2. Performance-based remuneration is a Duskin-designated standard model, and the percentage is subject to change based on performance.

Matters related to decisions on the remunerations, etc. for each Director

Individual remuneration amounts are determined as follows. Based on policy approved by the Board of Directors, the Board of Directors consults with the Directors Evaluation Committee concerning the basic remuneration amount for each Director, bonus appraisal allocation considering the business responsibilities of each Director, and allotted share proposals for each Director pertaining to share remuneration. The Board of Directors receives a report from the Committee and makes a decision via the Board approval process.

<Audit and Supervisory Board Member remuneration, etc.>

The total remuneration amount for all Audit and Supervisory Board Members is determined within the remuneration limits approved at the general meeting of shareholders, and individual Audit and Supervisory Board Member remuneration amounts are determined through discussion among Audit and Supervisory Board Members. Audit and Supervisory Board Member remuneration is composed of basic remuneration and bonuses.

| Category | Number of members | Total remuneration | Type of remuneration | ||

|---|---|---|---|---|---|

| Basic remuneration (fixed amount) |

Bonus (performance-based) | Restricted stock remuneration | |||

| Board Directors (Outside Directors) |

11 (4) |

328,044 (27,645) |

210,570 (27,645) |

83,200 (-) |

34,274 (-) |

| Audit and Supervisory Board Members (Outside Audit and Supervisory Board Members) |

8 (5) |

71,940 (23,850) |

71,940 (23,850) |

- (-) |

- (-) |

| Total (Outside officers) |

19 (9) |

399,984 (51,495) |

282,510 (51,495) |

83,200 (-) |

34,274 (-) |

- Notes

-

- 1. At the 56th Ordinary General Meeting of Shareholders held on June 21, 2018, a resolution was passed that the maximum amount of remuneration for Board Directors shall be 400 million yen per year (including 35 million yen for Outside Directors). At the closing of the most recent General Meeting of Shareholders, the number of Board Directors was nine (including three Outside Directors).

- 2. At the 45th Ordinary General Meeting of Shareholders held on June 27, 2007, a resolution was passed that the maximum amount of remuneration for Audit & Supervisory Board Directors shall be 95 million yen per year. At the closing of the most recent General Meeting of Shareholders, the number of Audit and Supervisory Board members was five (including three Outside Audit and Supervisory Board Members).

- 3. At the 59th Ordinary General Meeting of Shareholders held on June 23, 2021, a resolution was passed that restricted stock awards granted to Board Directors (excluding Outside Directors) shall meet the following conditions: not exceeding 50 million yen per annum while also not exceeding 20,000 shares of common stock per annum. The total amount shown above satisfies these conditions. At the closing of the most recent General Meeting of Shareholders, the number of Board Directors (excluding Outside Directors) was six.

- 4. The benchmark for bonuses for the fiscal year under review is profit attributable to owners of the parent of 8,808 billion yen for fiscal year 2024.

Succession Plan (Successor Development Plan)

Duskin formulated its succession plan to train next-generation management and successors to our chief executives. We have created a program to train those with the appropriate qualities, as well as a selection process for candidates for operating officers and director positions. We have launched these operations and regularly share information and report to the Board of Directors on the progress.

Furthermore, the President and CEO conducts periodic (monthly) individual interviews with all Operating Officers. Quantitative assessments of their performance are made every six months in line with the Directors Evaluation and Nomination System, with the opportunity used to provide further guidance as well as to review performance and capability improvement with them.

Training Board Directors and Audit and Supervisory Board Members and deepening their knowledge of Duskin.

We have also established an officer training program together with the succession plan, and have begun deploying them. Duskin provides periodic training that Board Directors and Audit and Supervisory Board Members need in order to perform their decision-making and executing duties, and training that Operating Officers need in order to perform their business duties.

When appointing Outside Directors, the President and CEO explains Duskin's management philosophy to the candidates. After confirming their agreement with the philosophy, the President and CEO further explains Duskin's business strategy and business operations. In addition, to help them deepen their knowledge of Duskin, the company provides them with opportunities to visit major business sites, training facilities and plants.