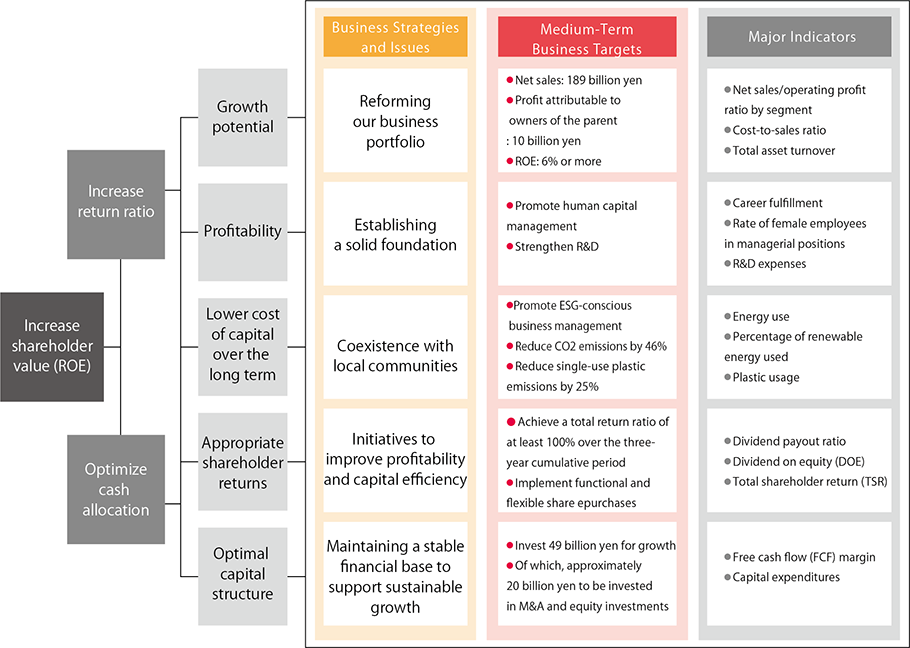

We will continue to make proactive growth investments, enhance asset efficiency and thereby improve ROE

- Kenji Iida

- CFO

In charge of the Corporate Planning Group

It is a top of the page.

In fiscal 2024 (the year ended March 31, 2025), Duskin posted higher sales and profits. On the sales front, sales from the Food Group surged significantly, driven by the strong performance of Mister Donut. The Direct Selling Group and the Other Businesses segment also saw increased sales. On the profit side, the improved cost ratio achieved by installing RFID tags contributed to the positive result. Furthermore, net profit attributable to owners of the parent reached its highest level ever since the company's listing. This was primarily due to the inclusion of JP-Holdings, Inc. as an equity method affiliate in the previous fiscal year, which increased profits, as well as the continued sale of strategically held shares.

Looking back at the Medium-Term Management Policy 2022 from a financial point of view, the past three years saw the completion of multiple M&A transactions and the advancement of proactive investments in growth areas. In addition, we were able to allocate a greater portion of financial assets and retained earnings toward shareholder returns, while considering the balance with growth investments. Return on equity (ROE) was 5.8%, an improvement of 0.3 percentage points from the base period, but fell slightly short of the initial target of 6%. In light of this result, we will intensify our efforts in growth investments and greater shareholder returns, and dedicate ourselves fully to improving future performance.

As part of our financial policies that underpin our business strategies and contribute to enhancing corporate value, we will implement shareholder return measures focused on optimizing shareholder capital while raising funds to support proactive growth investments.

The Medium-Term Business Plan 2028 outlines an even more proactive approach to investing than before. Specifically, we plan to allocate approximately 30 billion yen for growth investments, including about 20 billion yen for M&A, while allocating approximately 38 billion yen for maintenance investments. Among maintenance investments, we are prioritizing BCP investments as key initiatives, such as rebuilding the Wakura Duskin mop manufacturing plant damaged in the Noto Peninsula earthquake and implementing disaster risk reduction measures at the Ono Duskin mat manufacturing plant.

Among growth investments, for those contributing to digital transformation and enhancing customer experience value, we have set key objectives for each fiscal year and estimate the investment amounts needed to achieve those objectives. In contrast, the budget for M&A investments is currently a provisional estimate, as we are in the preparatory phase for future acquisitions.

Because the investment plan will exceed the estimated operating cash flow over the next three years of approximately 53 billion yen, we will simultaneously consider further reductions in strategic shareholdings and the utilization of financial assets.

Regarding strategic shareholdings, the Board of Directors holds annual discussions to verify the significance and rationality of holding such shares. We continue to engage in careful dialogue with all companies in which we hold shares to review the necessity of maintaining these strategic holdings.

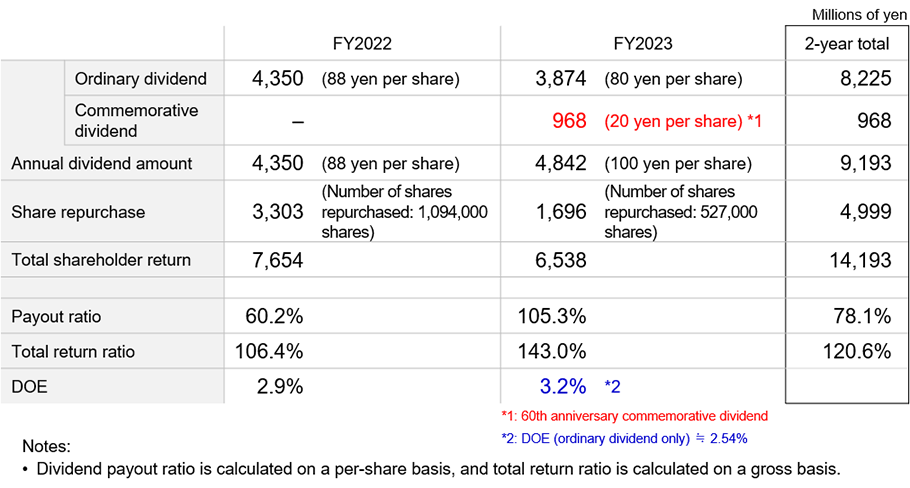

Regarding shareholder returns, in our previous Medium-Term Management Policy 2022 we had established a dividend policy targeting either a consolidated dividend payout ratio of 60% or a minimum dividend on equity (DOE) of 2.5%, whichever was higher. However, in the Medium-Term Business Plan 2028, we have raised this DOE benchmark to 3%. In the meantime, our fundamental policy—namely, maintaining sound financial health while adhering to appropriate profit distribution commensurate with performance—remains unchanged. As for stock repurchases, we are considering implementing them in a flexible and adaptable manner.

To advance M&A activities, we invested in the Kansai Innovation Network No. 2 Investment Limited Partnership operated by Senshu Ikeda Capital Co., Ltd. Additionally, we newly established an M&A Promotion office within the New Business Development department and recruited external personnel with specialized expertise in M&A. Furthermore, we are actively enhancing our organizational structure, including establishing an internal council dedicated to M&A. In addition, our efforts to gather information, including learning about numerous potential opportunities from financial institutions, achieved positive results, such as expanding our Duskin Rescue (rapid maintenance) service (through partnership and investment with Qracian Co., Ltd.) and entering the childcare-support sector (through partnership and investment with JP-Holdings, Inc.).

The primary focus of M&A targets will be peripheral areas of existing businesses, such as house maintenance and the development of new food service brands or business models. However, moving forward, we will explore broader forms of partnership, including expanding into untapped markets within Asia and developing new business models suitable for franchising.

Regarding investment proposals, we hold monthly meetings of the Investment Assessment Committee to deliberate on investment proposals before submitting them to the Board of Directors. I serve as chairman, and the committee members include the managers of Accounting, Legal Affairs & Corporate Compliance, Human Resources, and Quality Assurance & Risk Management. We also receive advice from our Outside Audit and Supervisory Board Members, who participate as observers.

The purpose of this committee is to identify key points for discussion at board meetings. To that end, the committee not only scrutinizes investment proposals from a quantitative perspective but also freely exchanges opinions from a comprehensive viewpoint, including legal compliance, quality assurance, risk management, and human resources and labor perspectives.

The committee also performs monitoring functions. It has established a system to issue alerts from an impairment risk perspective when investment projects fall below certain standards relative to their initial plans. For such projects, the committee identifies and scrutinizes issues to facilitate discussion at board meetings.

The regulations established by this committee are also reviewed as appropriate. For example, we have set a 10-year period as a benchmark for the investment payback period.

Based on the capital asset pricing model (CAPM) and other factors, we recognize the cost of shareholders' equity to be around 5% at present. While our ROE of 5.8% for fiscal 2024 slightly exceeds the cost of shareholders' equity, we recognize that market expectations for returns are at a higher level. Our goal is to gradually bring the actual return closer to the expected return.

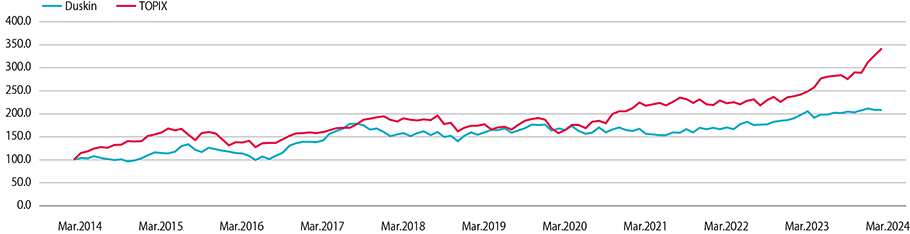

The price-to-book (P/B) ratio stood at 1.13 times as of March 31, 2025, maintaining a level above 1.0 times for the past three years. In addition, through careful dialogue with capital market participants, we have taken appropriate measures, such as incorporating the DOE standard as a lower limit indicator in our shareholder return policy. However, to truly enhance our corporate value — including improving the P/B ratio — we must present a growth strategy for the future and steadily execute it in order to achieve a consistent improvement in ROE.

In our Medium-Term Business Plan 2028, we have set targets of net profit of 10.6 billion yen and ROE of 7% or higher. However, we are looking beyond that, setting an even higher ROE target of 8% to 9% for the subsequent period.

To achieve this, we must strengthen our profit base and steadily improve capital efficiency. By clearly mapping out the path to higher ROE, we intend to guide the company toward being valued for its growth potential. To that end, we are continuing discussions on introducing return on invested capital (ROIC) as a profitability metric. However, because several challenges still remain, such as refining the balance sheet breakdown and establishing allocation criteria for shared expenses, we are currently sorting out these issues and deepening our discussions.

As CFO, my role is to focus on enhancing future corporate value by considering and executing optimal capital allocation in line with our corporate management philosophy and business strategies. Our consolidated net sales are nearly 200 billion yen. In order to allocate our company's cash resources in a balanced manner toward growth investments and shareholder returns, and thereby contribute to future top-line growth and bottom-line performance, we need to make judgments not only through quantitative scrutiny but also by paying close attention to whether decisions align with our corporate philosophy and social responsibility. Through such optimal capital allocation, and by sharing such allocation policies with our stakeholders, we intend to enhance our corporate value.

I myself will continue to support business growth from a financial perspective to ensure the timely execution of the three-year cash allocation outlined in the Medium-Term Business Plan 2028. At the same time, I intend to enhance capital efficiency by equally focusing on the analyses of the balance sheet and the profit and loss statement, thereby fostering sustainable and stable business growth.

In closing, I kindly ask our stakeholders for their ongoing understanding and support of our business strategies and financial policies.