The scope of the Medium-Term Management Policy 2022 is the three years from the fiscal year ending March 31, 2023 to the fiscal year ending March 31, 2025. This three-year period is set as the third phase of the ONE DUSKIN long-term strategy. We will strive to spark further growth in the foundation constructed in the first and second phases, implement initiatives to mark the completion of our long-term strategy, and make every effort to expand our corporate value.

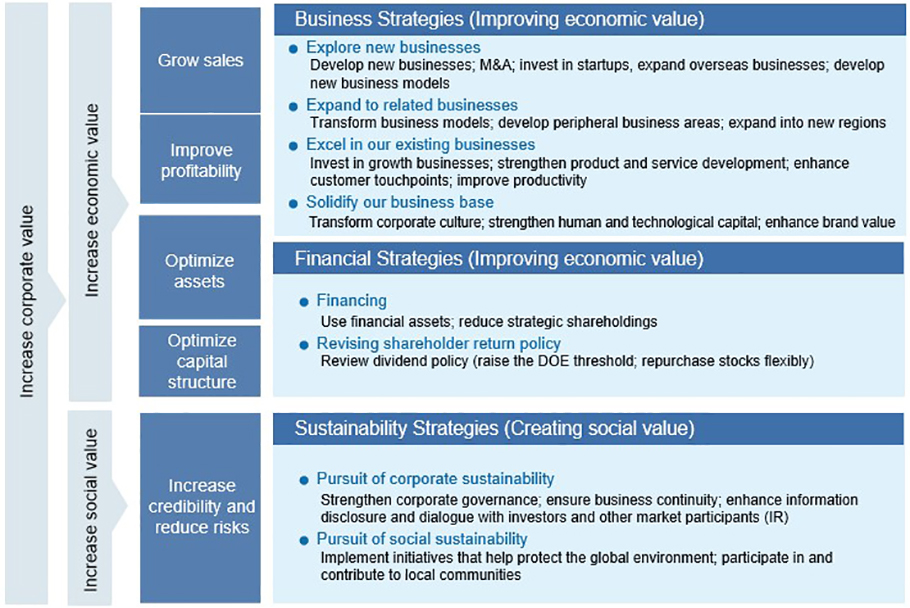

Since its founding, Duskin has placed the philosophy of unifying business and morals at the heart of all its operations. The business element hints at our pursuit of sustainable growth while serving our local communities, that is, enhancing economic value. To this we add our goal to enhance social value implied by the morals as we take genuine pleasure in striving to live up to society's expectations.

In other words, unifying business and morals is all about pursuing greater economic and social value alike, which will ultimately enhance our corporate value. We will continue to stay true to this belief.

We will expand our business domains and strengthen our value chain through new products and services.

In line with our goal of helping customers fine-tune the rhythm of their daily lives and working environments, we place highest priority on hygiene and cleanliness. We are making every effort to rebrand our corporate image into a company forging clean and healthy environments. In addition to hygiene and cleanliness domain, we also aim to expand work-life management and senior support areas.

We are committed to developing new business models that cater to different locations, customer base and needs than the existing brands while also boosting the value chain through the internalization of major raw material processing and distribution for current businesses.

We plan to introduce new technologies and restructure our business model by actively investing in M&A, venture capital and R&D, in domains where we currently fall short of maintaining lifelong relationships with customers, but also in those addressing social issues such as conservation of the global environment, declining birthrate, aging society and regional revitalization, and that are also expected to harness synergies with existing businesses in the future.

Besides pursuing growth in the countries where we are already present, we are considering further expansion into new countries after carefully assessing the situation in each country, including the market environment.

We are advancing human capital management focused on securing a diverse workforce and on developing and utilizing the human resources required to reform our business portfolios. At the same time, we are working on boosting R&D through efforts such as enhancing the company's development capabilities and promoting open innovation. Furthermore, we are driving new efficiencies through digitalization and other means with the utmost goal of laying the foundation for our companywide digital transformation (DX) strategy.

In light of the purpose of the revised Corporate Governance Code, we are moving forward with initiatives that will help create a governance structure appropriate for the Prime Market.

We aim to enhance the company's environmental value by contributing to the creation of a decarbonized, recycling-oriented society. Among our continuous efforts are investments meant to reduce our environmental footprint.

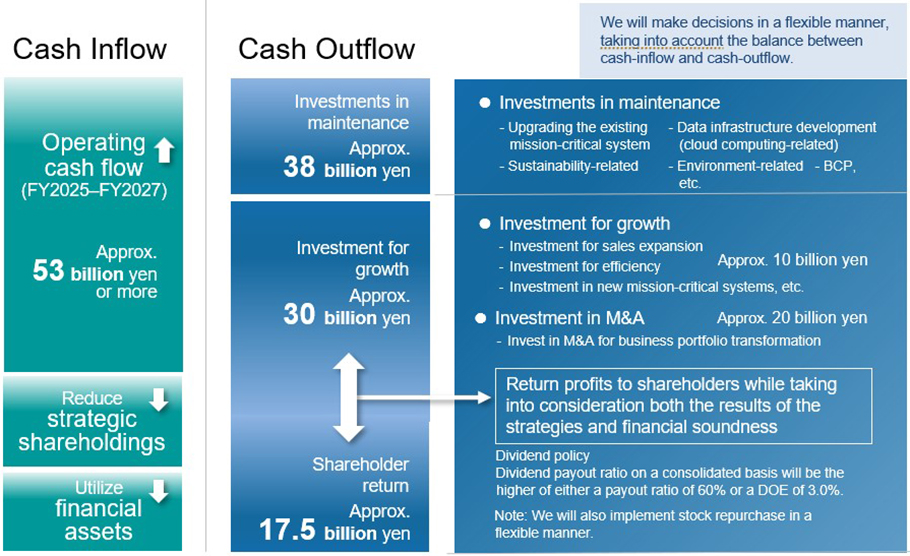

We will engage in bold investments in new growth opportunities to rebuild our business portfolios. Also, we are committed to improving capital efficiency by various means, such as reducing financial assets and considering borrowing from financial institutions, in addition to utilizing operating cash flows during the three-year period.