We are committed to further boosting growth and maximizing corporate value with dynamic investment and an agile financial strategy

- Naoto Miyata

- Board Director and CFO

Corporate Administration Group

It is a top of the page.

The fiscal year ended March 31, 2023 (FY2022) concluded with business results that for the most part conformed with our forecasts. We believe this positive outcome despite a weakening yen and sharply rising raw material costs is thanks to a Group-wide commitment to attaining our targets and to a steady and dedicated effort.

In addition, these results benefitted from the smooth implementation of price revisions aimed at ensuring a reliable supply of products for our customers for certain products offered by the Clean Service business, the Direct Selling Group's core business, and by Mister Donut, the Food Group's core business.

Net sales increased for every segment as economic activity returned to normal after the coronavirus pandemic. Most notably, the success of the Mister Donut product strategy had a very positive impact on business results. In addition, the increase in the number of shops in operation to nearly 1,000 due to new shop openings also contributed to higher sales.

On the profit side, while boosting sales activities and sales promotions back to the level they were before the pandemic resulted in higher expenses, we consider this a constructive investment that will yield returns in the future. In addition, the ongoing installation of RFID electronic tags, a strategic investment for the Direct Selling Group, increased the cost of sales by approximately 1,100 million yen. Although this was in line with our original projection, it was in fact a factor in lower profits.

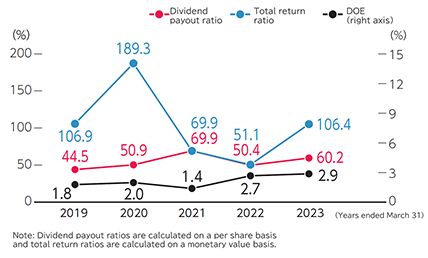

Despite this decrease in profits, however, based on a 60% consolidated payout ratio, dividend per share increased for the third fiscal year in a row to 88 yen, a year-on-year increase of 5 yen.

| (Millions of yen) | Results | Y-o-Y (%) | ||

|---|---|---|---|---|

| Consolidated | Direct Selling Group | Net sales | 108,469 | 1.3 |

| Operating profit | 8,114 | -23.0 | ||

| Food Group | Net sales | 48,879 | 11.6 | |

| Operating profit | 5,473 | 51.2 | ||

| Other Businesses | Net sales | 16,229 | 5.3 | |

| Operating profit | 702 | -19.5 | ||

| Intersegment eliminations and corporate expenses | Net sales | -3,085 | — | |

| Operating profit | -5,652 | — | ||

| Net sales | 170,494 | 4.5 | ||

| Operating profit | 8,637 | -12.7 | ||

| Consolidated operating profit | 11,375 | -6.9 | ||

| Profit attributable to owners of parent | 7,196 | -11.5 | ||

For the fiscal year ending March 31, 2024 (FY2023) — given that the economy is changing at a dizzying tempo — we will continue to pick up the pace of our efforts to meet our targets, with the awareness that it is vital that we acquire information concerning business opportunities and risks in a more timely manner than ever and execute business based on a rapid decision-making process.

In order to further develop the household market for the Clean Services business, the Direct Sales Group has adopted and appraised a sales approach using dedicated sales teams at the company-owned units and affiliated companies throughout Japan. Now that we have verified that the approach is achieving good results, we will further promote this approach to include franchisees around Japan. In terms of overall Duskin Group business performance, the results that the Clean Service business achieves in the market will be positioned as a key issue. Meanwhile, for the Food Group, Mister Donut continues to perform well, and the outlook is that sales will continue to rise for this core business.

Turning to profits, along with other factors, we consider rising prices adversely affecting profits. Higher personnel costs due to increased base pay is another factor for the decline in profits. In particular, given the rapidly growing labor shortage, there is great concern about sharply rising personnel costs for part-time positions.

As for our personnel cost issue, we will boost productivity by fundamentally reforming the way the corporate administrative departments conduct their businesses, thereby reducing overhead costs. With this in mind, there is currently discussion within the company from a human capital management perspective about how best to change our human resource portfolio. Looking ahead, during the period of the Medium-Term Management Policy 2022, we intend to present our medium- and long-term approach to human resources for both recruitment and training.

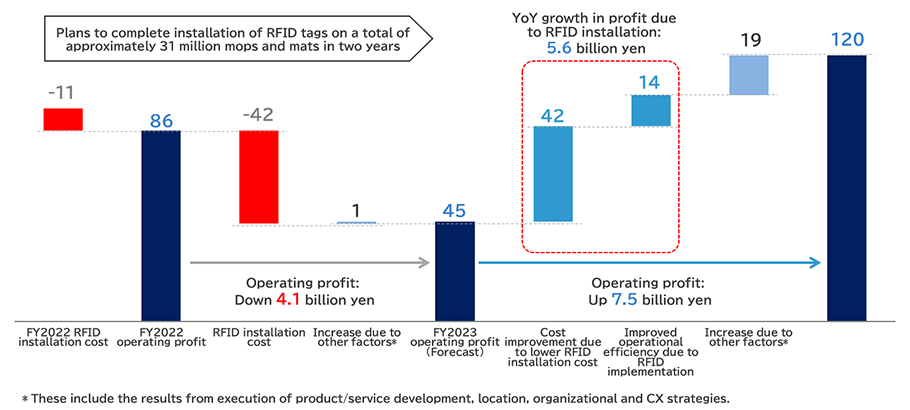

I should also note that while net sales for FY2023 are forecast to be 178,700 million yen, a 4.8% increase over the previous year, our strategic investment in RFID electronic tags imposes a temporary but significant rise in sales costs that is expected to generate a decrease in profit attributable to owners of parent of 38.9%, equivalent to 4,400 million yen.

As mentioned earlier, a major strategic investment is attaching an RFID electronic tag to every Duskin mat and mop rental product in distribution — some 31 million in total — ahead of the system going into full-blown operation in 2024. This will mark a major advance toward converting our laundry plants into smart factories.

Since the cost of attaching RFID electronic tags is accounted as a small-sum depreciable asset that will generate a temporary sales cost increase of around 4,200 million yen, for FY2023, we expect an operating profit of 4,500 million yen, a year-on-year decrease of 47.7%.

In contrast to this decrease, however, for the fiscal year ending March 31, 2025 (FY2024), the year the system begins operation, lower attachment costs, more efficient work procedures, as well as the benefits from other increases in sales are expected to generate an operating profit of 12,000 million yen, a 166.7% increase over FY2023.

In addition, since spreading out the cost burden is difficult, during the three-year period of the Medium-Term Management Policy 2022, we changed to a dividend policy focused on continually generating a stable cash dividend.

Specifically, in addition to a dividend payout equivalent to a consolidated dividend payout ratio of 60%, we have also set a dividend on equity (DOE) of 2.5% as a lower-limit indicator and base the dividend payout on whichever is higher. This method ensures a stable dividend. Moreover, along with actively carrying out the timely and flexible repurchasing of company shares, our policy is to provide a profit return targeting a cumulative three-year total return ratio of 100% or higher.

Thanks in part to the support of our shareholders and investors regarding our dividend policy, and given a steadily rising current share price and a stable price-to-book ratio (P/B ratio) of at least 1.0, we believe our financial strategy is reaping good results. (As of March 31, 2023, our share price was 3,190 yen and P/B ratio was 1.02.)

Regarding strategic shareholding, our policy is to limit such holdings to an appropriate number of shares when it is reasonable to do so and to reduce or divest our equity interest when there is no valid reason to hold a particular stock as determined by a detailed dialogue with the subject company. During the fiscal year ended March 31, 2018 (FY2017), Duskin's strategic shareholdings totaled 25 companies but had declined to 20 companies by FY2022, for a net decline of five companies over that five-year period.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Equity ratio | 77.0% | 76.6% | 77.2% | 76.1% | 76.6% |

| Return on equity (ROE) | 4.0% | 3.8% | 2.0% | 5.5% | 4.8% |

| Return on assets (ROA) | 3.1% | 3.0% | 1.5% | 4.2% | 3.6% |

| Price-to-earnings (P/E) ratio | 23.45 | 25.84 | 48.70 | 16.33 | 21.83 |

| Price-to-book (P/B) ratio | 0.92 | 0.99 | 0.94 | 0.88 | 1.02 |

| Total shareholder return (TSR) (TOPIX Total Return Index) |

99.56% (94.96%) | 109.27% (85.94%) | 108.68% (122.15%) | 108.19% (124.57%) | 130.03% (131.82%) |

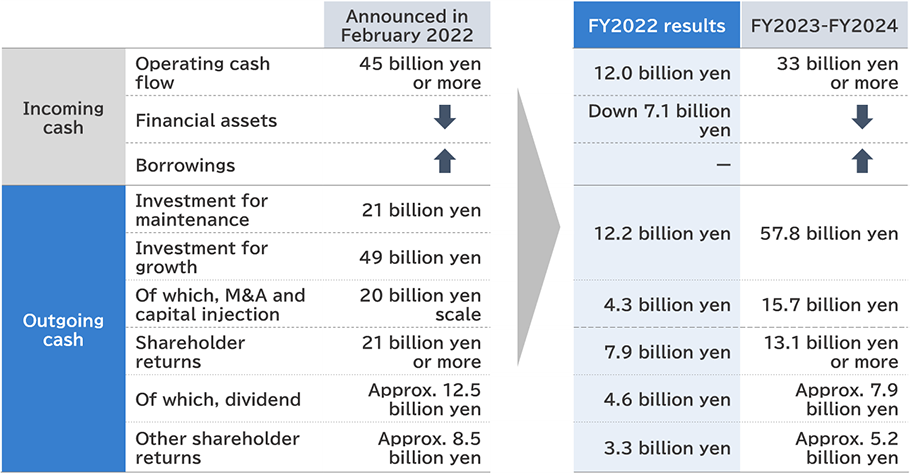

We have always conducted sound business management on a solid foundation of ample shareholders' equity. With the winding down of the coronavirus pandemic, we intend to flexibly put our capital to work, with an emphasis on expanding our business in domestic and overseas markets.

During the pandemic, we widely spread the "a brand forging healthy environments" message through various initiatives. Moreover, as our name becomes even more associated with making society safer and more worry-free, we are receiving numerous proposals to form business alliances and take part in investment opportunities. We feel that the response has been excellent, and we will take full advantage of these opportunities to pursue even more growth.

One of our first efforts to make effective use of our capital was through an M&A initiative in November 2022, when we formed a business alliance with Qracian Co., Ltd. and acquired the shares of the holding company Nile Holdings (now Qracian Holdings Co., Ltd.).

We plan to make up to 49,000 million yen in growth investments during the three-year period of the Medium-Term Management Plan 2022, and as the chairman of the Investment Assessment Committee I am fully prepared to make investment decisions even more quickly than we have up to now. Moreover, we need to be keenly aware of the importance of investment monitoring — including post-merger integration or PMI, the integration process after M&A by which a company maximizes the positive effects of consolidation — and we therefore intend to thoroughly monitor our investments.

Reforming our business portfolio also requires a proper evaluation of each business. Moreover, we need to move promptly without delay on such measures as setting KPIs that conform to our business strategy and thoroughly scrutinize and monitor each business from a capital cost perspective.

We intend to enhance corporate value by listening sincerely to our stakeholders and conducting a constructive dialogue with them. In particular, for our shareholders and investors we strive to provide a return on profits not only in the short term but through sustainable growth from a medium- and long-term perspective. With all this in mind, I hope for your continued support.